In sharemarket news on Thursday, Air New Zealand upgraded its profit forecast and Auckland International Airport flagged higher aeronautical charges.

Michael Wood, the MP for Mt Roskill and a Cabinet Minister, said he had sold his Auckland Airport shares that have been a source of controversy and which led to him being stood down as transport minister. Wood owned just over 1500 shares (worth an estimated $13,000) in the airport company that he bought as a teen.

The sale of Auckland Airport shares was also the centre of attention in local government politics as Auckland Council met to vote on the annual budget, including a proposal from Mayor Wayne Brown to sell the council’s stake in the airport to repay debt.

Auckland International Airport slipped 0.06% to $8.58 after it announced increases to its aeronautical charges paid by airlines for the next five years, taking effect from July 1.

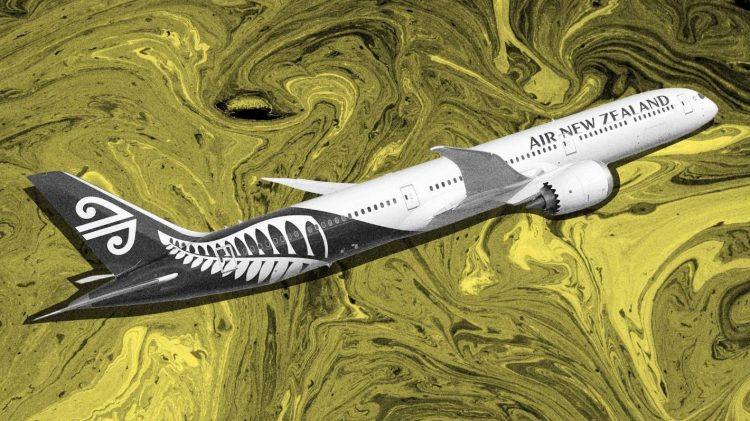

Air New Zealand gained 1.3% to 78 cents after raising its annual profit forecast for a second time in just a few months.

The national airline said it expects profit before tax and one-time items of at least $580 million in the year to the end of June as it benefits from strong demand for travel and weaker jet fuel prices.

On Wednesday, Infratil said it had agreed to buy the remaining half stake in telco One New Zealand from its partner Brookfield Asset Management for $1.8 billion.

The new shares are expected to start trading on June 14.

The company plans to offer $100m of shares to retail investors on June 13.

Credit: stuff.co.nz