The Reserve Bank (RBNZ) is warning about the threats posed by a sharp fall in house prices or a rise in unemployment.

In its six-monthly financial stability report the governor, Adrian Orr, said the big financial shocks from the pandemic have yet to be felt because of various official support measures.

“The relatively resilient economic outturn means that the New Zealand financial system has not been tested as severely as it could have been. The banking system has maintained strong buffers of capital and liquidity, and the insurance sector remains well capitalised.

“The government’s fiscal support, in particular the wage subsidy scheme, has stabilised the labour market and household incomes.”

But the central bank’s report noted low-deposit home loans had grown and deputy governor Geoff Bascand said if unchecked, could threaten financial stability.

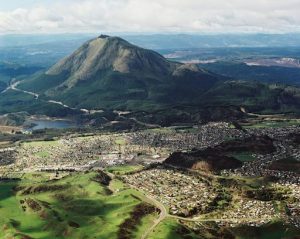

“High leverage in the housing sector poses risks if house prices fall sharply or unemployment rises, reducing the ability to service loans. This is why the Reserve Bank intends to re-impose LVR [loan-to-value ratio] restrictions to guard against continued growth in high-risk lending and ensure that banks remain resilient to a future housing market downturn.”

The report noted the recent growth in house prices increased the risk of a sharp correction in the medium term, if the demand and supply imbalances were unwound.

The RBNZ report said despite economic stress faced by businesses and households yet to show up in bank metrics, significant downside risks remained.

“The continued spread of Covid-19 around the world, the ongoing closures of international travel links, and the risk of further domestic outbreaks, are weighing on businesses’ investment intentions.”

Demand for business credit has been weak overall, with outstanding credit contracting about 8 percent since March.

Bascand reiterated the point that retail banks should continue to lend and they had ample funding to meet customer needs.

“For its part, the Reserve Bank remains committed to supporting the long term financial stability of our economy, this is why we have undertaken a number of temporary regulatory actions to ensure that banks have sufficient capacity to remain supportive. Ongoing capital relief and a continuation of banks’ dividend restrictions both support the continued provision of credit, particularly to the business sector.”

Source: RNZ News – www.rnz.co.nz