The Reserve Bank says any further easy money policy measures will have the simple aim of lowering the cost of borrowing and ensuring banks have enough cheap liquidity to back investment by businesses and spending by households.

In a briefing on its two favoured mechanisms – funding for lending (FLP), and negative interest rates – the central bank said it would have the lending programme ready to go from November, although the final decision on deployment would be made by its Monetary Policy Committee.

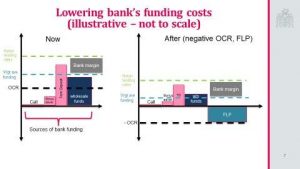

Under the FLP, the RBNZ would lend to banks at around the official cash rate (OCR), currently 0.25 percent, with few conditions on how it should be passed on to businesses and households.

“You want it to be freely available and you want it to be taken up, potentially at scale, to lower the funding costs so that they can pass it on,” Assistant Governor Christian Hawkesby said.

He said the design had yet to be finalised but it would be kept simple with as few conditions as possible.

“You want to keep it as simple as you can. Any conditionality, you want to be simple. You don’t want it to end up inhibiting the scheme [from] being used.”

Hawkesby said the lending scheme could go ahead without negative rates, but together they were the next best options to support the economy through the pandemic.

He gave no hint how much might be lent through such a scheme nor how long it would last.

“The punchline is, it will be a substantial size.”

RBNZ chief economist Yuong Ha said the measures the bank had taken so far – the bond-buying programme, term lending facility, lower OCR, and foreign exchange swaps – had been effective in lowering interest rates, such as two-year mortgages by more than three-quarters of a percentage point, which meant more cash for spending and cheaper money for businesses and households to borrow.

The bank’s response to the pandemic was characterised as a “least regrets” approach.

“We would rather be in the situation where we have done too much too soon, rather than too little too late,” Ha said.

He accepted that one consequence of further monetary stimulus and cheaper rates would be to fuel house and other asset prices, such as shares.

But Ha said that was how policy worked, and creating wealth in itself also stimulated spending, noting that a fall in house prices would be a risk to recovery.

BNZ senior economist Craig Ebert said the RBNZ was sounding extremely dovish.

“This is the Reserve Bank effectively, and aggressively, easing policy well before it feels entirely able to cut the Official Cash Rate (OCR) into negative territory.”

“Today’s rhetoric from the RBNZ leaves us of the view it will cut the OCR into negative territory before too much longer. Practically, this takes the form of a 50 basis point cut, to -0.25 percent at the 14 April [2021] Monetary Policy Review.”

SOURCE: RNZ